HDFC BANK LTD

We are starting analysis Of HDFC (Housing Development Finance Corporation) Bank. HDFC BANK was established in 1940. HDFC Bank was incorporated in 1994 as a subsidiary of HDFC ltd, which received an 'in principle' approval from the RBI to set up a bank in the private sector, as part of its liberalization of the Indian banking industry. The bank commenced operations on January 1995, with its registered office in Mumbai It is India's largest private sector bank by assets and the world's tenth largest bank with market capitalization as of May 2024. As of April 2024, HDFC Bank has a market capitalization of $145 billion, making it the third-largest company on the Indian stock exchanges. On 4 April 2022, HDFC ltd was merged with HDFC bank. Wikipedia (Click here).

HDFC Bank provides a number of products and services including wholesale banking, retail banking, treasury, auto loans, two-wheeler loans, personal loans, loans against property, consumer durable loan, lifestyle loan and credit cards.

subsidiary companies of HDFC Ltd:

- HDFC Life Insurance Company : Established in 2000, HDFC Life is a leading long-term life insurance solutions provider in India, offering a range of individual and group insurance solutions that meet various customer needs such as Protection, Pension, Savings, Investment, Annuity and Health.

- HDFC Asset Management Company: HDFC Asset Management Company Limited was incorporated as a Public Limited Company on December 10, 1999 and obtained its certificate for commencement of business on March 9, 2000 from the ROC. The Company is engaged in the business of providing asset management services to HDFC Mutual Fund and alternative investment fund and portfolio management and advisory services to clients.

- HDFC ERGO General Insurance Company: It was Founded in the year 2002, HDFC ERGO General Insurance Company operates in 106 Indian cities with over 120 branches and 3000+ employees across the country. The Company offers complete range of general insurance products ranging from motor, health, travel, home and personal accident in the retail space and products like property, marine and liability insurance in the corporate space.

HDFC Capital Advisers Ltd: HDFC Capital Advisers Limited was established in 2015 as a subsidiary of HDFC Ltd. HDFC Capital Advisers Limited is a real estate private equity investment manager that provides long-term debt and equity financing for housing projects in India. The company's mission is to address the affordable housing supply gap in India by financing the development of one million affordable homes

- HDFC Securities Ltd: HDFC Securities was established in 2000 as a subsidiary of HDFC Ltd. provide a 360-degree view of financial planning options that suit your future goals and needs.

- HDB Financial Services: HDB Financial Services Ltd was incorporated in Ahmadabad on 4th June 2007 as a non deposit taking Non Banking Finance Corporation (NBFC). It offers business loans at affordable interest rates. Apart from business loans, it also offers personal loans, gold loans, auto, and commercial vehicle loans.

- HDFC Credila: The Bohora brothers, Anil and Ajay, founded HDFC Credila in 2006 after facing difficulties getting education loans for their studies in the US. In 2019, HDFC acquired the Bohora brothers' 9.12% stake in the company for Rs 395 crore.

| NAME | Type | Ownership |

| HDFC Life | Life insurance | 50.37% |

| HDFC ERGO | General insurance | 50.48% |

| HDFC Asset Management Company | Mutual funds | 52.55% |

| HDFC Securities | Stockbroking | 95.48% |

| HDB Financial Services | Consumer finance | 94.84% |

| HDFC Capital Advisors | Private equity real estate | 90% |

| HDFC Credila | Education finance | 9.99% |

- Listing

HDFC Bank was listed on the Bombay Stock Exchange in May 1995 and the National Stock Exchange in November 1995. It was listed on the New York Stock Exchange in 2001.

- International operations

HDFC Bank has four branches in Hong Kong, Bahrain, and Dubai, and an IFSC Banking Unit in Gujarat International Finance Tech City. It also has five representative offices in Kenya, Abu Dhabi, Dubai, London, and Singapore.

- Market capitalisation

As of April 2024, HDFC Bank had a market capitalisation of $145 billion, making it the third-largest company on the Indian stock exchanges

Fundamental Analysis:

Believe that while analysis any company, an investor should always look at the company as a whole and focus on financials, which represent the business of the entire company including its subsidiaries, joint ventures, associates etc.

The company, likely in the banking or financial sector, has a substantial market capitalisation of ₹12.34 lack crores, with a strong CASA ratio of 38.19%, reflecting a low-cost deposit base. It has 763.08 crore outstanding shares and is trading at a P/E of 18.98 and a P/B of 2.71, indicating moderate valuations. With a dividend yield of 1.18%, the company also offers returns to its shareholders. Its book value per share is ₹597.09, and it boasts an impressive net interest income of ₹1.08 lack crores. The cost-to-income ratio stands at a low 40.18%, showing operational efficiency. The company has no promoter holding, possibly signifying broad institutional or public ownership. The earnings per share (EPS) is ₹85.23, and the Capital Adequacy Ratio (CAR) is a healthy 18.8%, ensuring financial stability. The company delivers strong returns with a Return on Equity (ROE) of 16.97% and a Return on Capital Employed (ROCE) of 15.26%, alongside notable profit growth of 37.87%. Overall, these company with efficient operations and solid growth potential.

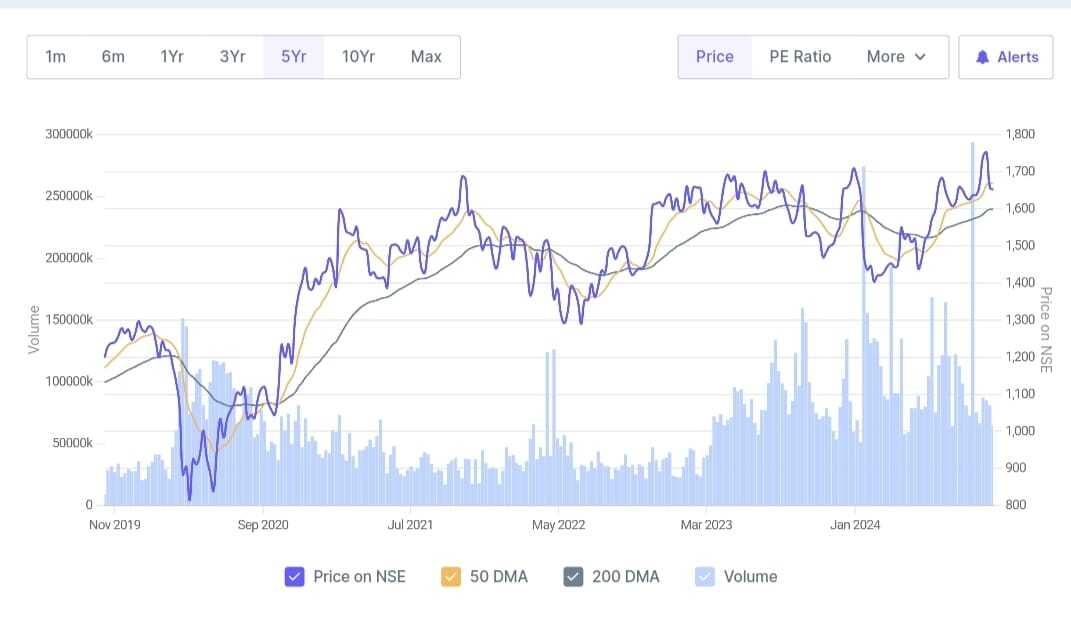

Chat Analysis:

Source: https://www.screener.in/

HDFC stock price chat shows us the price and volume of a security listed on the National Stock Exchange of India (NSE) over a period of approximately five years. The blue line represents the daily closing price, while the yellow and green lines represent the 50-day and 200-day moving averages, respectively. The light blue bars at the bottom indicate the daily trading volume. The chart shows us general upward trend in the stock price over the period, with some fluctuations. The moving averages provide a smoother representation of the price trend, helping to identify potential support and resistance levels. The volume bars indicate periods of high and low trading activity, which can provide insights into the strength of price movements.

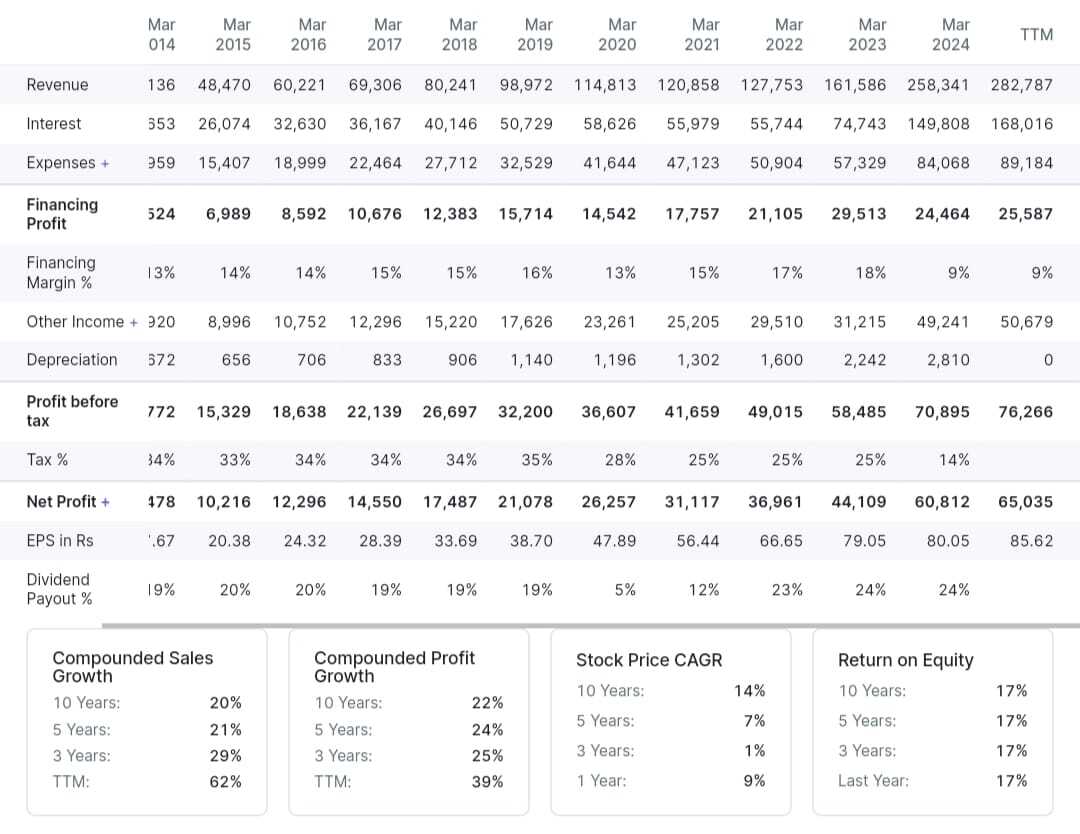

Profit and loss statement:

Source: https://www.screener.in/

This table illustrates that financial performance of a HDFC ltd over the 10 years from March 2014 to March 2024, including trailing twelve months (TTM) data. Revenue has increased from ₹136 in March 2014 to ₹258,341 in March 2024, with TTM revenue reaching ₹282,787, indicating growth. The compounded sales growth over 10 years is 20%, 21% over 5 years, 29% over 3 years, and a remarkable 62% for TTM. Financing profit grown from ₹524 in 2014 to ₹25,587 in the TTM period, though the financing margin, which ranged between 13-18%, dropped to 9% in March 2024. Net profit also saw substantial growth, rising from ₹478 in 2014 to ₹60,812 in 2024, with TTM at ₹65,035. The compounded profit growth was 22% over 10 years, 24% over 5 years, 25% over 3 years, and 39% in TTM.

Earnings per share (EPS) followed a similar upward trajectory, increasing from ₹0.67 in 2014 to ₹80.05 in 2024, with a TTM EPS of ₹85.62. Profit before tax grew steadily from ₹772 in 2014 to ₹76,266 in TTM, underscoring consistent profitability. The company’s tax rate declined significantly from 34% in 2014 to 14% in 2024. Dividend payouts have remained relatively consistent, fluctuating between 19% and 24%, reflecting a stable dividend policy. Stock price CAGR over the past 10 years was 14%, 7% over 5 years, 1% over 3 years, and 9% for TTM. Return on equity (ROE) has consistently been 17% over the past decade, demonstrating stable returns on investments. Overall, the company's performance showcases healthy revenue and profit growth.

Balance Sheet:

Source: https://www.screener.in/

By seeing Balance Sheet of HDFC ltd we can see equity, liabilities, and assets from March 2016 through a projection in March 2024. Over this period, Equity Capital has seen a gradual increased, starting from 506 in 2016 to 558 in 2023, with a marked jump to 760 projected by 2024. This indicates the company’s strengthening capital base. Simultaneously, Reserves have grown significantly, from 72,172 in 2016 to a projected 439,486 in 2024, showcasing a robust accumulation of retained earnings or surplus profits over the years, reflecting financial health and possibly reduced dividend payouts or reinvestment into the business. The company’s Borrowings have surged dramatically during this period, rising from 631,393 in 2016 to a foretasted 3,041,939 in 2024. This sharp increase in debt indicates that the company is financing a substantial portion of its growth or operations through external loans, which might be fuelling its asset base but also increasing its financial obligations. As a result, Total Liabilities show a clear upward rising from 740,796 in 2016 to a projected 3,617,623 in 2024. This is indicative of growing commitments, not only due to increased borrowings but also due to a rise in Other Liabilities, which have more than tripled from 36,725 in 2016 to 135,438 in 2024. On the Asset side, Total Assets have increased in line with the company’s liabilities, reaching 3,617,623 in 2024, reflecting balanced growth across the balance sheet. This growth in assets is primarily driven by a rise in Investments, which have more than tripled from 195,836 in 2016 to 702,415 by 2024, and Other Assets, which show a similar trend, increasing from 541,617 in 2016 to 2,903,809 in 2024. The increase in investments points toward strategic allocation of capital to long-term growth opportunities, while the rise in other assets may indicate expansion in operational capacities or acquisitions. Fixed Assets have grown modestly, reaching 11,399 in 2024, suggesting that the company’s growth is more reliant on financial or operational expansions rather than heavy capital investment in physical infrastructure.

Conclusion:

HDFC Bank has strong financial growth and operational efficiency over the past decade. The bank large market capitalisation, solid revenue growth, and consistent profitability reflect its dominant position in the financial sector. With impressive net interest income, healthy capital adequacy, and robust returns on equity and capital employed, HDFC Bank is well-positioned for sustained growth. The rise in borrowings and liabilities is balanced by significant asset growth, particularly in investments, reflecting the bank's strategic focus on long-term expansion.