ITC. LTD

Hello everyone,

We are starting analysis Of ITC.LTD. ITC ltd was established in 1910 with the name Imperial Tobacco Company of India Limited. Later, it was renamed I.T.C. Limited in 1974. ITC Limited is a diversified conglomerate with businesses spanning Fast Moving Consumer Goods (FMCG), comprising Foods, Personal Care, Cigarettes and Cigars, Education & Stationery Products, Incense Sticks and Safety Matches, Hotels, Paperboards and Packaging, Agri Business and Information Technology. In terms of market capitalization, ITC is the second-largest FMCG company in India and the third-largest tobacco company in the world. It has employs 36,500 people at more than 60 locations across India. (Read More)

Brief about business diversification

Cigarettes: ITC is the market leader in cigarettes in India. With a portfolio 78% and invaluable brands, brands including, Insignia, India Kings, Classic, Gold Flake, American Club, Wills Navy Cut, Players, Scissors, Capstan, Berkeley, Bristol, Flake, Silk Cut, Duke & Royal. The share of the cigarette business to ITC's business in revenue terms has dropped from 47 per cent in FY13 to 37 per cent in FY23 on a larger revenue base.

FMCG: ITC has a strong presence in the FMCG segment with a huge product portfolio catering to packaged food, personal care, and education, and stationary. Top brands in the FMCG segment include Ashirwad which is No. 1 brand in the Aata segment, SunFest is No. 1 in cream biscuit segment, Bingo with No. 1 brand in the snack food segment, Yippee is No. 2 brand in noodles segment, Classmate is No. 1 brand in notebooks. Mangaldeep Agarbatti is No. 2 brand in the Agarbatti segment. Some of the other brands include Savlon, Engage, Fiama, Vivel, Nim Wash, B-Natural, Mint-O, Candyman, Papercraft, etc. FMCG is the fastest-growing segment of ITC and the most promising business category

Personal Care Products: ITC forayed into the Personal Care business in July 2005. In the short period since its entry, ITC has launched an array of brands like EDW Essenza', 'Dermafique','Fiama', 'Vivel', 'Engage', 'Savlon', 'Charmis', 'Shower to Shower', 'Nimyle', 'Nimwash' 'Nimeasy' and 'Superia'.

Education & Stationery: ITC made its entry to the education and stationery business with its Paperkraft brand in the premium segment in 2002; and later expanded into the popular segment with its Classmate brand in 2003. By 2007, Classmate became the largest Notebook brand in the country. Together, Classmate and Paperkraft offer a range of products in the Education & Stationery space to the discerning consumer, providing unrivalled value in terms of product & price.

Hotels:, ITC Hotels, Launched in 1975. India's premier chain of luxury hotels, has become synonymous with Indian hospitality. ITC Hotels pioneered the concept of 'Responsible Luxury' in the hospitality industry, drawing on the strengths of ITC groups' exemplary sustainability practices.

Agri Business: ITC's pre-eminent position as one of India's leading corporates in the agricultural sector is based on strong and enduring farmer partnerships that has revolutionized and transformed the rural agricultural sector.

ITC's Agri Business sources from over 20 crop value chain clusters across 22 states in India

- Feed Ingredients - Soyameal

- Food Grains - Wheat & Wheat Flour, Rice, Pulses, Barley & Maize

- Marine Products - Shrimps and Prawns

- Processed Fruits - Fruit Purees/Concentrates, IQF/Frozen Fruits, Organic Fruit Products

- Coffee

- Packaging & Printing Business: ITC's Packaging & Printing Business is the largest value added converter of paperboard packaging in South Asia. It converts over 1,00,000 tonnes of paper, paperboard and laminates per annum into a variety of value-added packaging solutions for the food & beverage, personal & home care products, cigarette, liquor, quick service restaurants and consumer goods industries.

- Information Technology: ITC Infotech was founded in 2000. ITC Infotech is a global technology solution and services leader providing business-friendly solutions, that enable future-readiness for clients. It gives services to enterprises in many industries, including banking, financial services, healthcare, manufacturing, consumer goods, travel, and hospitality.

- Safety Matches: ITC commenced marketing safety matches sourced from the small-scale sector. The Safety Matches business leverages the core strengths of ITC in marketing and distribution, brand building, supply chain management and paperboard & packaging to offer Indian consumers high quality safety matches. popular brands like Aim, Ship and Homelites.

- Paperboards and Specialty Papers: ITC's Paperboards and Specialty Papers Business is the leader in volume, product range, market reach and environmental performance, and is the clear market leader in the value-added paperboards segment. Providing internationally competitive quality and cost, the Business caters to a wide spectrum of packaging, graphic, communication, writing, printing and specialty paper requirements.

Revenue Split by Product Segments

- FMCG - Cigarettes: 44.1%

- FMCG - Others: 27.1%

- Hotels: 4.0%

- Agri Business: 6.7%

- Paperboards, Paper and Packaging: 12.3%

- Others: 5.8%

Revenue Split by Geography

- Revenue within India: 83.6%

- Revenue outside India: 16.4%

fundamental analysis for ITC Limited

Believe that while analysis any company, an investor should always look at the company as a whole and focus on financials, which represent the business of the entire company including its subsidiaries, joint ventures, associates etc.

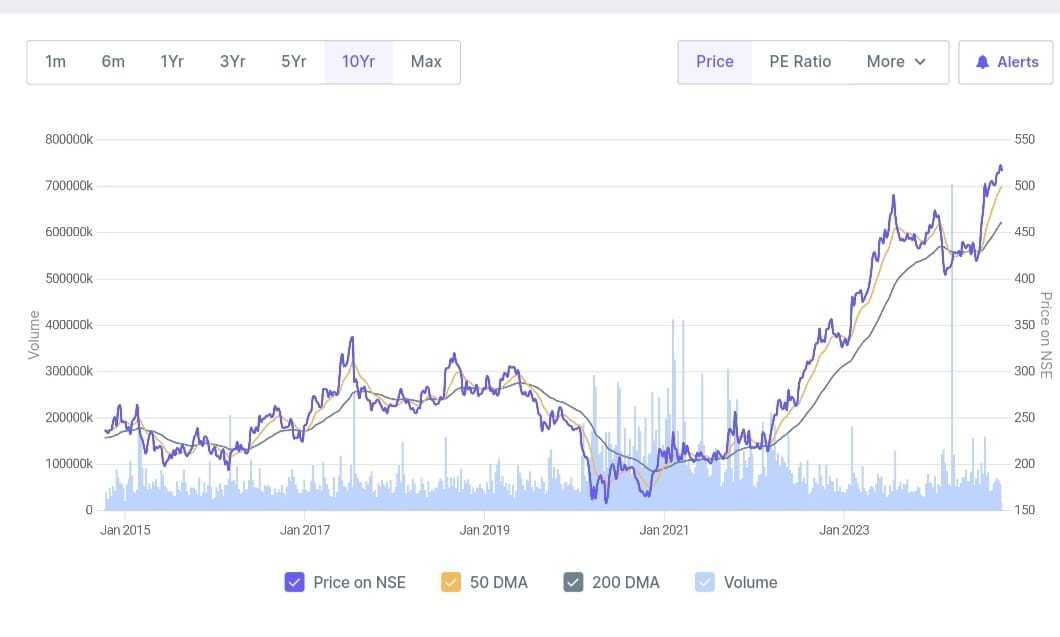

CHAT ANALYSIS LAST 10 YEARS

Source https://www.screener.in

PROFIT AND LOSS STATEMENT LAST 10 YEARS.

As per observation, the company exhibited consistent growth in sales, rising from 31,618 in March 2013 to 72,174 in March 2024. This sales growth is accompanied by a corresponding increase in expenses, which grew from 20,398 to 45,841 during the same period. Despite the rise in expenses, the company managed to maintain a healthy operating profit margin, fluctuating between 35% and 39%. Net profit also showed a positive trend, increasing from 7,704 in March 2013 to 20,739 in March 2024. This consistent growth in net profit is reflected in the EPS, which rose from 6.42 to 16.39. The dividend payout ratio, however, varied significantly throughout the years, reaching a peak of 101% in March 2020

Source https://www.screener.in

Summary

- Profit growth: ITC has shown a 16.15% profit growth over the past three years.

- Return on equity (ROE): ITC has maintained a healthy ROE of 28.23% over the past three years.

- Return on capital employed (ROCE): ITC has maintained a healthy ROCE of 36.42% over the past three years.

- Interest coverage ratio: ITC has a healthy interest coverage ratio of 347.53.

- Operating margins: ITC has maintained an average operating margin of 34.18% over the past five years.

- Cash conversion cycle: ITC has an efficient cash conversion cycle of 15.33 days.

- Liquidity position: ITC has a healthy liquidity position with a current ratio of 2.91

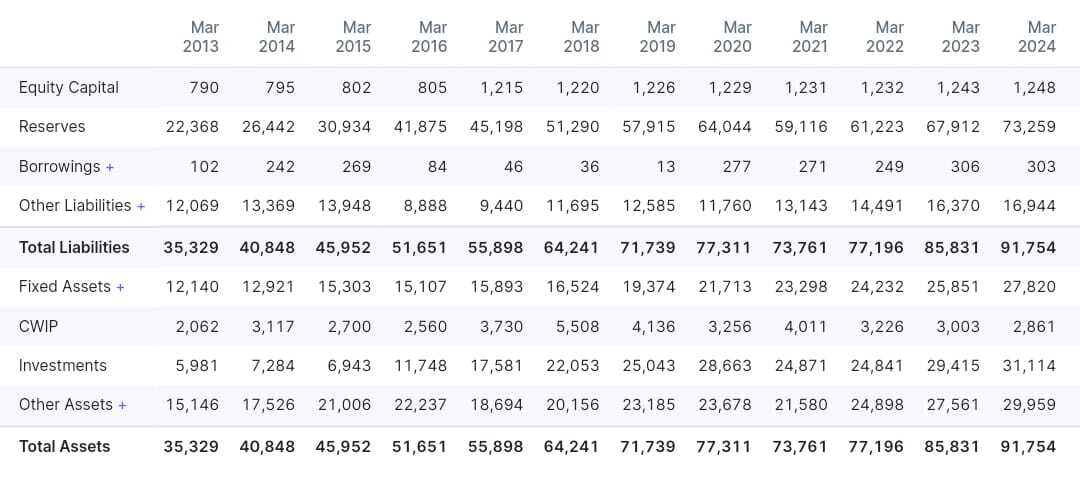

Balance sheet

Source https://www.screener.in

The company's financial position has evolved steadily over the years, as evidenced by key components of its liabilities and assets. Equity Capital, reflecting shareholders' investments, has shown slight growth, moving from 790 in March 2013 to 1,248 in March 2024. Reserves, which represent accumulated profits, have grown significantly, increasing from 22,368 in 2013 to 73,259 in 2024, demonstrating a strong profit retention strategy. Borrowings fluctuated, peaking at 277 in March 2020 and rising to 303 in March 2024, indicating some variations in debt levels. Other Liabilities, which include obligations such as trade payables, have grown from 12,069 in 2013 to 16,944 in 2024, signaling expanding business operations.

On the assets side, Fixed Assets have grown significantly, from 12,140 in 2013 to 27,820 in 2024, reflecting increased investment in tangible long-term assets. Capital Work in Progress (CWIP) has shown some variability, peaking at 5,508 in 2018, hinting at substantial ongoing projects during that period. The company’s Investments have surged, reaching 31,114 by 2024, showing a robust portfolio of financial assets. Finally, Other Assets, which encompass items such as inventories and receivables, have seen steady growth, reaching 29,959 by 2024, indicating solid management of working capital.

Summary

The company's total liabilities and assets have both increased significantly from March 2013 to March 2024, indicating substantial growth in the company's operations.

The company seems to be financially stable, with a healthy mix of equity and debt financing. The consistent growth in reserves indicates profitability over the years.